When sales and marketing run in separate directions, everyone feels it. Marketing complains about “lazy follow-up.” Sales grumbles about “bad leads.”

Meanwhile, revenue stalls. It’s not a talent problem, it’s a focus problem. Both teams are chasing different goals, and that disconnect burns resources faster than it builds pipeline.

The fix is simple but not easy: create a shared target.

That means moving away from vanity metrics like impressions or downloads and anchoring everything to revenue impact. If sales and marketing can’t look at the same scoreboard, they’ll keep playing different games.

Here’s how you start closing that gap:

- Define one set of goals tied directly to revenue growth.

- Write down exactly what qualifies as an MQL and SQL in a service-level agreement so nobody debates it later.

- Hold weekly check-ins where both sides review progress and troubleshoot together.

- Track the numbers that matter: SQL conversion rate, average deal size, and win rate.

- Keep it transparent with a single dashboard both teams use daily.

This doesn’t just stop the finger-pointing. It also forces everyone to own the pipeline together. When both teams pull from the same rope, deals move faster, and the constant bickering over lead quality starts to fade.

1. Build a Crystal-Clear ICP

If your targeting is too broad, you’re basically paying to talk to people who were never going to buy in the first place.

That’s the danger of vague ICPs: you fill the funnel with irrelevant leads, burn through ad spend, and frustrate your sales team with conversations that go nowhere.

A strong demand gen engine starts with clarity. Your ICP should go beyond job titles and industries. The best strategies layer in firmographics, technographics, and buying triggers.

For example, it’s not just “mid-market SaaS” but “SaaS companies between $2M–$5M ARR using HubSpot, recently posting job listings for demand gen roles.” That level of specificity gives you focus.

The other piece is discipline. You don’t need ten different segments. You need two or three that have the highest potential to convert.

When you spread thin, you dilute both your message and your spend. A focused ICP means your campaigns can speak directly to the right people instead of shouting into the void.

Here are practical steps that make it work:

- Build a detailed ICP using firmographics, technographics, and buying triggers.

- Narrow focus to no more than two or three priority segments.

- Use intent data tools to spot which accounts are actively researching solutions.

- Track lead-to-SQL conversion, cost per qualified lead, and pipeline velocity by segment.

The goal isn’t just getting leads in the door. It’s making sure the right leads are entering the pipeline and moving through it with speed. That’s how you shift from wasted ad dollars to real revenue momentum.

2. Measure What Actually Moves the Pipeline

Random acts of content are expensive. You can crank out blog posts, record podcasts, and host webinars, but if none of it helps buyers take the next step, it’s just noise. Demand gen is about creating momentum, not filling a calendar with activity for activity’s sake.

The more effective way forward is to map the buyer journey. Ask yourself: what questions does my buyer have when they first realize the problem, when they’re comparing solutions, and when they’re ready to decide?

That’s your roadmap. If you align content to each of those stages, you’re no longer guessing, you’re guiding.

It’s also about making sure your sales team isn’t left scrambling. Sales collateral should mirror the same journey so the buyer doesn’t feel a jarring shift between marketing’s message and sales conversations. That consistency builds confidence and keeps deals from stalling.

Here are a few actions that make this work in practice:

- Map key buyer questions across awareness, consideration, and decision stages.

- Assign specific content formats to each stage: guides for awareness, webinars for consideration, case studies for decision.

- Ensure sales collateral follows the same flow so the buyer’s experience feels seamless.

- Track content attribution, engagement by stage, and pipeline acceleration to know what’s working.

When you measure impact this way, you shift from producing content to producing revenue. That’s how you stop wasting time on noise and start building a pipeline that actually moves.

3. Stop Betting on a Single Channel

Relying on one channel is like trying to balance a chair on a single leg. It might hold for a moment, but sooner or later it tips.

When demand gen leans too heavily on just email, or just paid ads, or just outbound, you create a fragile pipeline that collapses the minute that channel slows down. The result is inconsistent engagement and unpredictable revenue.

The better play is to think in terms of orchestration. Buyers rarely respond after the first touch. In fact, most need to see your brand five to seven times before they’re ready to even consider a conversation.

That means email nurtures, LinkedIn visibility, paid search intent, and outbound calls all working together. It’s not about volume, it’s about clear and intentional sequencing.

Content should also work harder. A single webinar can be clipped into LinkedIn posts, turned into a blog, and repurposed into an email sequence.

This keeps your presence consistent without burning out your creative team. It’s how you build momentum across channels instead of starting from scratch every time.

Here’s how to make it practical:

- Run integrated campaigns across email, LinkedIn, paid search, and outbound.

- Orchestrate at least five to seven touches before deciding whether a lead is qualified.

- Repurpose content into multiple formats to extend reach and efficiency.

- Track multi-touch attribution, cost per opportunity, and campaign ROI to see where the lift is coming from.

A multi-channel approach doesn’t just spread risk. It compounds exposure. When prospects encounter you in different contexts, trust builds faster and the path to pipeline becomes a lot smoother.

4. Create Content That Sells, Not Just Attracts

A common trap is chasing lead volume. Marketing hits the gas on gated content, free trials, or generic ads, and sure enough, the lead count goes up.

But when sales looks at those names, most don’t fit the ICP and few ever turn into revenue. High volume with low value is just an expensive vanity metric.

Rather, you need to be focusing on pipeline value. Instead of bragging about the number of leads generated, ask how much qualified pipeline those leads actually created. This forces marketing to think less about filling the database and more about fueling deals that matter.

Lead scoring helps tighten this up. When you combine behavioral data with firmographic filters, you can quickly separate tire-kickers from real buyers.

The earlier you filter out weak leads, the more time sales spends on prospects with genuine potential. That creates a healthier pipeline and a much clearer view of ROI.

Here are practical steps to reset the focus:

- Swap lead volume targets for pipeline value sourced.

- Score leads using both behavioral and firmographic data to flag the right buyers.

- Filter out unqualified leads before they clog sales pipelines.

- Track CAC, pipeline value generated per campaign, and SQL rate to see where content actually drives deals.

Content should move people closer to a decision, not just lure them into the top of the funnel. When you build with revenue impact in mind, you avoid the trap of chasing numbers that look good on paper but never hit the bottom line.

5. Build Brand Trust Like It’s Currency

Spray-and-pray marketing tactics almost always backfire. You might get some activity in the short term, but they rarely resonate with high-value accounts.

The result is a pile of “leads” that sales can’t close and a brand that feels more like noise than a trusted partner.

Instead of chasing anyone who clicks, work with sales to identify the 50 to 100 accounts that actually matter. These are the accounts with the highest revenue potential and the greatest strategic fit. By narrowing the field, you give yourself room to deliver deeper, more personalized engagement that actually sticks.

Personalization doesn’t have to mean rewriting every email from scratch. It means tailoring outreach around industry pain points and buyer personas, then aligning those plays with broader marketing support.

Think industry-specific ads, content crafted for decision-makers, and events that feel exclusive rather than generic. When marketing air cover matches sales plays, buyers see consistency and start to trust the message.

Here’s how you can make it real:

- Select 50 to 100 priority accounts with direct input from sales.

- Personalize campaigns by industry challenges and buyer role.

- Align sales outreach with marketing air cover through ads, targeted content, and curated events.

- Track account engagement score, opportunity creation in target accounts, and deal velocity.

When buyers feel like you understand their world, trust becomes the differentiator. And in B2B, trust often decides whether a deal accelerates or disappears.

6. Create Accountability for Pipeline Health

One of the oldest battles in business sounds like this: marketing says, “We drove leads.” Sales replies, “They weren’t good.” And nobody owns the outcome. It’s a cycle that keeps both teams busy but leaves revenue stalled.

The fix is to give marketing skin in the game. Their KPIs can’t stop at leads generated. They need to be tied directly to revenue.

That means tracking how much pipeline was sourced by marketing and how much revenue marketing influenced throughout the deal cycle. When the scoreboard shows dollars instead of downloads, accountability gets real.

Sales and marketing should also share visibility into what’s actually happening in the CRM. If reporting shows where deals came from, what influenced them, and how they moved through the funnel, it eliminates the guessing game. Suddenly, the conversation shifts from finger-pointing to problem-solving.

Practical steps that make this work:

- Tie marketing KPIs directly to revenue outcomes, not just lead counts.

- Use CRM reporting to show both sourced and influenced revenue.

- Hold quarterly pipeline reviews with both teams in the room.

- Track marketing-sourced pipeline, marketing-influenced pipeline, and close rate by source.

When both teams share responsibility for pipeline health, they also share the wins, and that changes the culture from conflict to collaboration.

7. Invest in Data and Attribution

A lot of teams make decisions based on gut feel. The problem is, gut feel doesn’t tell you if your spend is efficient.

Without clean data and attribution, you don’t actually know which campaigns or channels are generating real returns, you’re just guessing. And guessing is an expensive way to run demand gen.

The fix starts with tracking CAC like a hawk. Don’t just look at it in aggregate. Break it down by channel, by segment, and even by campaign.

This level of granularity shows you exactly where money is working and where it’s being wasted. If CAC for a channel is higher than one-third of your LTV, it’s time to cut or reallocate that spend.

At the same time, pay attention to how spend influences pipeline velocity. A channel that brings in slightly higher CAC but accelerates deal cycles might still be worth it. The key is making decisions with context, not just surface-level numbers.

Here’s how to keep it practical:

- Calculate CAC per channel, per segment, and per campaign.

- Cut spend on channels where CAC is greater than one-third of LTV.

- Double down on channels where CAC efficiency improves pipeline velocity.

- Track CAC by channel, CAC payback period, and LTV:CAC ratio consistently.

When attribution and cost metrics are baked into your process, every dollar has a purpose. And when every dollar has a purpose, your demand gen engine becomes both sharper and more sustainable.

8. Balance Short-Term Wins With Long-Term Demand

It’s easy to celebrate big pipeline numbers. But if those deals take forever to convert, you’re not really building momentum, you’re just stacking names in a spreadsheet. A bloated pipeline with slow-moving deals is more liability than asset.

That’s where pipeline velocity comes in. The formula is simple:

Pipeline Velocity = (SQLs × Win Rate × Deal Size) ÷ Sales Cycle Length

This metric tells you how quickly revenue is moving through the system, not just how much potential sits in the funnel. Faster cycles mean more cash in the door and more room to reinvest.

Improving velocity starts with qualification. If sales is spending time on the wrong deals, cycles drag. Tighten qualification criteria so only the right prospects move forward.

Then layer in content and sales enablement that reduces friction at each stage from FAQs, ROI calculators, and case studies. Anything that answers objections before they become delays.

Here’s how to put it into practice:

- Track pipeline velocity using the formula consistently.

- Shorten cycles by raising the bar on qualification.

- Equip sales with content and tools that move deals faster.

- Monitor pipeline velocity, average sales cycle, and deal conversion rate.

When you balance quick wins with long-term demand creation, you avoid the trap of chasing big but stagnant pipeline. Instead, you create revenue flow that compounds and sustains growth.

9. Treat Demand Gen as a Living System

The market isn’t static, and neither are buyers. Competitors shift their positioning, objections evolve, and budgets tighten or expand depending on the quarter.

If marketing builds a strategy once and leaves it untouched, it quickly turns stale. That’s when campaigns fall flat and pipeline slows.

The way around this is to treat demand gen like a living system that learns and adapts. A big piece of that comes from sales. If marketing doesn’t know what reps are hearing in the field, they’re essentially running blind. Recording and analyzing calls with tools like Gong or Chorus gives marketing a direct line into real buyer conversations.

Pair that with monthly win/loss reviews, where sales and marketing unpack why deals were won or lost. Share insights on objections, competitor mentions, and gaps in messaging or content. Those patterns become fuel for sharper campaigns, better collateral, and faster deal cycles.

Here’s how to keep the system alive:

- Record and analyze calls to capture real buyer language.

- Run monthly win/loss reviews across sales and marketing.

- Share insights on objections, competitor mentions, and content gaps.

- Track win/loss ratio, objection trends, and competitive deal outcomes.

A living demand gen strategy doesn’t just respond to changes, it anticipates them. When teams stay connected to the field and keep adjusting, the system gets smarter with every cycle, and revenue growth becomes a lot more predictable.

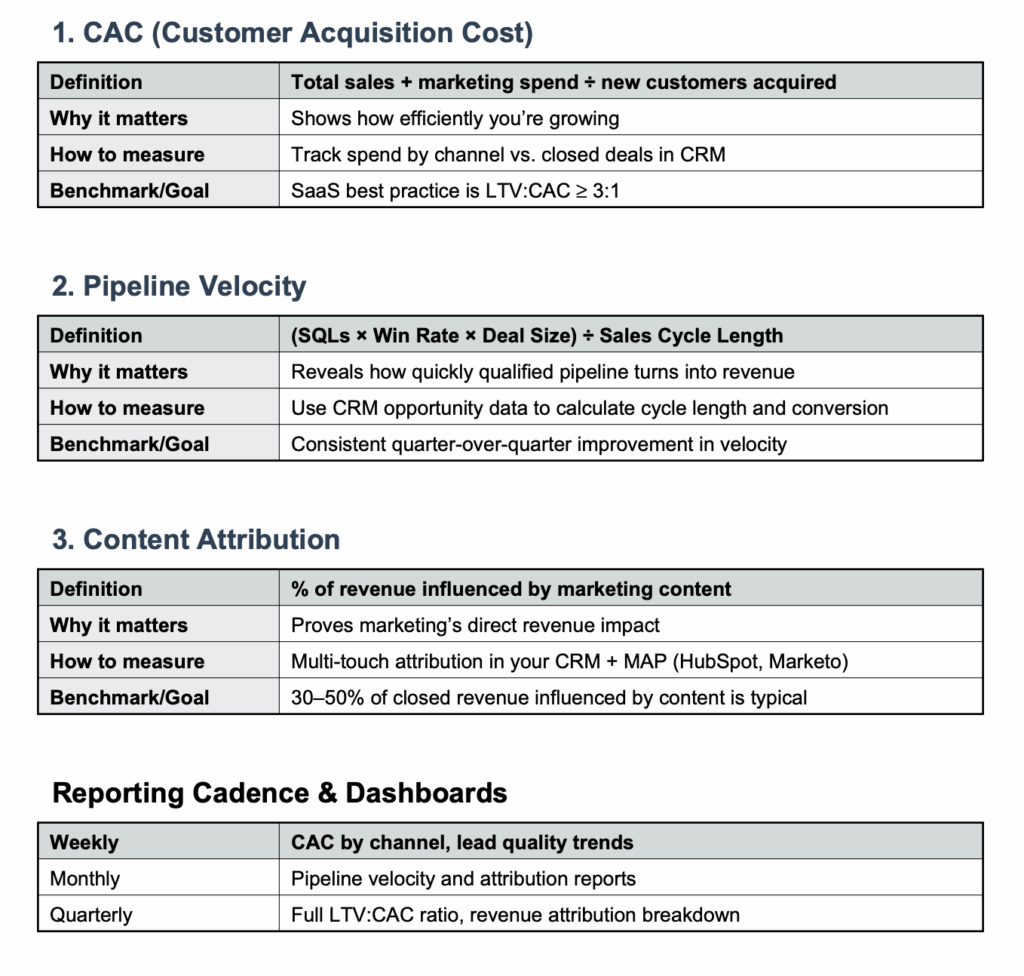

10. KPIs and Measurement

Demand gen strategy without measurement is just a shot in the dark. Here’s how to operationalize it:

Dashboard & cadence:

- Weekly: CAC by channel, lead quality.

- Monthly: Pipeline velocity, content attribution.

- Quarterly: Full revenue attribution, LTV:CAC ratio.

Tools: CRM (Salesforce/HubSpot), MAP (Marketo/HubSpot), BI tools (Tableau/Looker).

Your data should be a place to have deeper conversations about what is working, what isn’t, and where improvements can be made. This is a team effort. Siloed departments = missed goal targets.

If your current demand gen feels more like busywork than revenue growth, it’s time to change that. We build strategies that drive brand trust, pipeline, and revenue you can measure.

Book a discovery call today and see what a real demand gen partner looks like.